Stanley Fischer has held many important academic, business and policy-making positions at the World Bank, the International Monetary Fund and Citicorp. From 2014 to 2017, he served as vice chair of the U.S. Federal Reserve System. But from 2005 to 2013, Fischer was Governor of the Bank of Israel, and therein lies a story.

Born and raised in Rhodesia, Fischer was a passionate Zionist by the time of his bar mitzvah. Seven years later, in 1960, this spurred him to travel to Israel to study on a kibbutz. Yet his interest in monetary policy led him to the United States, eventually holding tenured positions in the University of Chicago’s renowned economics department and then at the Massachusetts Institute of Technology before moving to the World Bank.

His devotion to Israel has never wavered, and his contributions to the Jewish state were especially notable during two distinct periods.

The first came in 1985 when inflation in Israel reached an annual rate of 450 percent. With the economy in crisis, money was pouring out of the country. Action was needed. So Fischer joined his friends and frequent academic co-authors Michael Bruno and Rüdiger Dornbusch in crafting a plan that called for Israel to drastically cut its government deficit, and to use wage and price controls to stabilize its currency. It was a bold and vital move, whose implementation is regarded by some as the beginning of Israeli capitalism.

Two decades later, Fischer accepted the post of governor of the Bank of Israel. It was not destined to be a dull tenure, as a few years later the financial crisis struck. Fischer helped navigate Israel through it calmly and brilliantly. Regulations that he imposed helped keep the Israeli banking sector secure. He also allowed the shekel to depreciate and expanded the Israeli monetary base, so that banks would have enough cash on hand and borrowers could obtain sufficient credit.

The result? By early 2009, Israel’s housing market sharply rebounded. This was so much the case that Fischer was actually able to raise central-bank interest rates that year, even as other bankers around the world were keeping money as cheap as possible. With the hindsight of a decade, one can only marvel at how Israel passed through the financial crisis with a stable economic system and extremely strong economic growth.

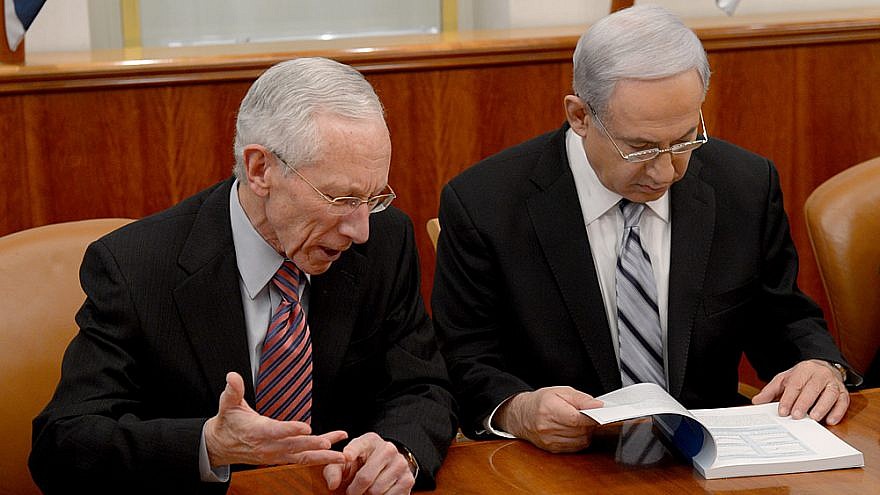

Fischer, along with Prime Minister Benjamin Netanyahu, also led Israel into the Organization of Economic Cooperation and Development, a select assemblage of the world’s 30 most developed nations. This was a sign that Israel had become something of an economic powerhouse and a respected economy in the world.

Stanley Fischer’s wise counsel and sturdy leadership at pivotal moments played no small part in that development.